For many arithmetic operations, percentages are necessary instead of whole numbers, or at least the best choice. Since calculating percentages by hand can be very tedious, Excel offers good assistance here. In the following we have put together a few tricks for you to use percentage calculations in Excel.

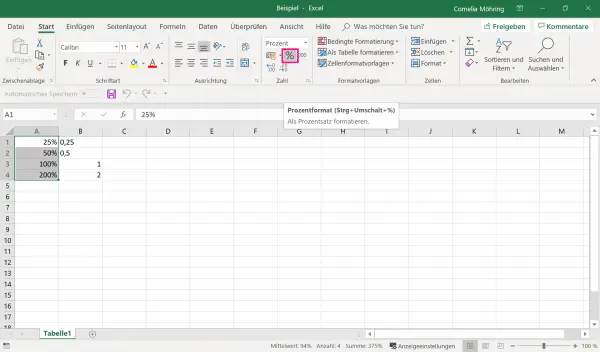

Convert decimal numbers to percentages

Select the cell (s) that you want to convert to percentages. Then click on the percent symbol in the " Start " tab in the menu bar . Here all numbers are automatically converted. Alternatively, you can also use the key combination [Ctrl] + [Shift] + [%] .

Attention: Since percentages are normally given as decimal numbers from 0 to 1, Excel equates the number 1 with 100%.

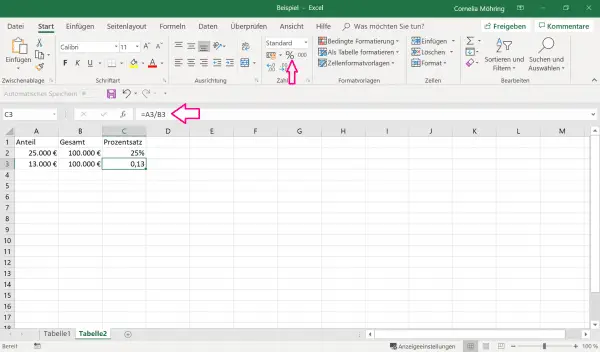

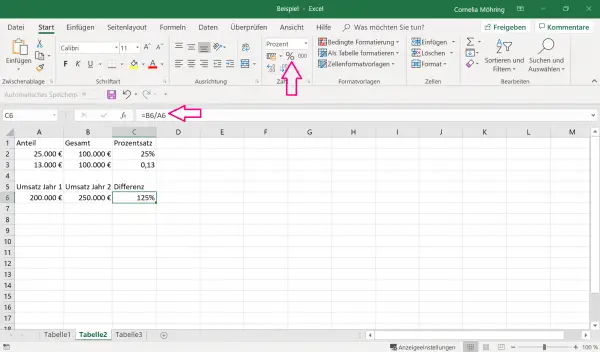

Specify percentage ratios

Here you can specify both what percentage of a whole a certain part makes up, as well as a change between two numbers in percent.

In the following picture you can see that the cell with the total was divided by the cell with the proportion. This then results in a decimal number that you can convert to a percentage using the method described above..

The next picture shows you how to calculate a percentage change. In the example, we want to determine the relationship between sales from year 2 and sales in year 1. For this purpose, the sales from year 2 are divided by the sales from year 1 and the whole is displayed as a percentage. If you just want to see the increase or the loss, you can label another field. Here you have to write = 100- [cell name] . In the placeholder for the cell name, simply enter the cell that shows the percentage ratio (in the example, C6).

Calculate percentages

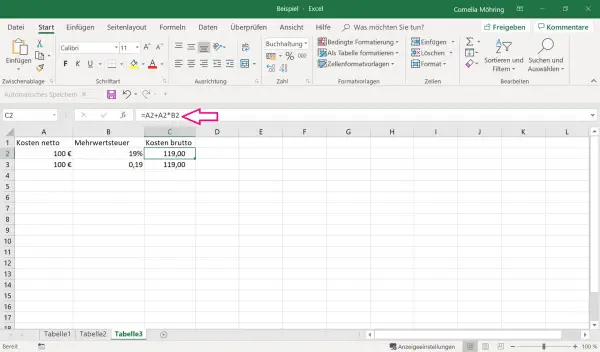

For example, if you want to add a tax or commission to your income, you can easily do that too. Just write down your amount and the corresponding percentage.

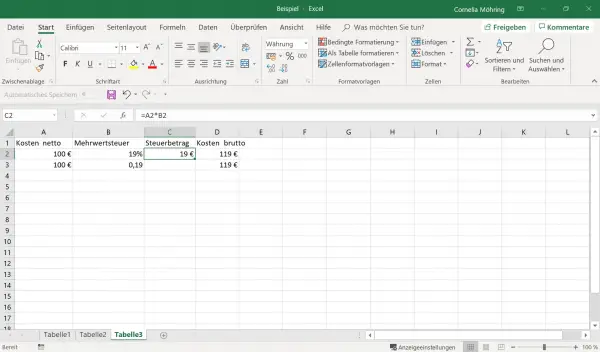

The example is to calculate how large the final amount is after adding up the sales tax. The value added tax is given as 0.19, which was converted into the percentage 19% using the above method. Field C2 calculates how much tax is due by multiplying the net cost by the tax rate. You can also use this method to generally calculate how large a certain percentage of a population is..

You can also calculate what the final amount will be. To do this, add the tax amount calculated above and the net costs in a new cell. If you are not interested in the intermediate step for calculating the tax amount, you can also directly carry out an invoice in which you calculate the tax amount and add it directly to the net costs. This is how you get the gross amount.